Building Lasting Family Wealth

From Issue #1

Imagine a loving family in the typical everyday struggle of earning money, keeping the family happy and healthy and raising loving children into adulthood. They grow considerable wealth and enjoy the benefits of the assets they’ve acquired. They talk about retirement and leaving a legacy for their children but like 70% of most people in their 50s and beyond, they procrastinate. Finally, the husband decides to book an appointment with an estate planning attorney. Unfortunately, just days before the appointment the husband passes.

“My inspiration comes from helping to keep family relationships strong, while at the same time, creating long lasting legacies through successful transition of family wealth to generations down the line. 70% of wealth transitions fail and I don’t want my clients to be part of that 70%.”– Vanessa

With no estate plan in place, the state of California took hold of the family assets. The wife ended up losing their family home and the children received very little of what their father intended for them. The family was heartbroken. True story. Couldn’t happen to you? Unfortunately, this situation is more common than you think.

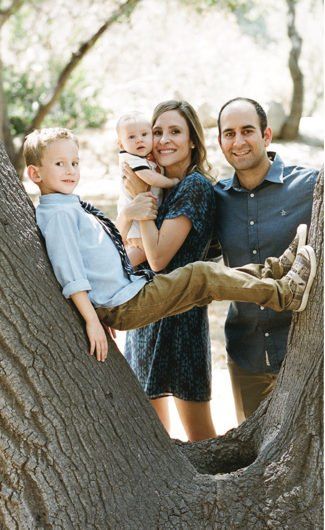

Let’s meet the law firm who helped this family put their financial house in order and get back some peace of mind. Vanessa and Ed Terzian of Terzian Law Partners.

3W: Vanessa why don’t 70% of people have an estate plan, will or health directive in place?

Vanessa: We procrastinate by nature. We only do things when we have to and people don’t like to talk about death and dying, its right up there with going to the dentist.

3W: Is it painful for the family to discuss this with you?

Vanessa: Not at all. In fact, when our first meeting is over I often get big group hugs from the family. They tell me this was so much easier than they thought and they’re so relieved they finally have a plan and know what each family member’s involvement will be when the time comes.

Ed: Vanessa is being modest, so I want to add something about her. Of course, I am a bit bias as her husband and partner, but she has a gift. She knows how to bring families together and make them comfortable in the process. She is professional and incredibly knowledgeable as an attorney, but at the same time, people relate to her. Her time as a trust officer at Wells Fargo, working with portfolio managers and beneficiaries really helped her understand the family dynamic and how important it is to have everyone on the same page.

Vanessa: I do think that when we joined our practices, our estate planning process became a more complete start to finish approach. Ed’s background in trust and probate litigation helps us prepare more complete estate plans for our clients. Ones that avoid the usual pitfalls. We try to anticipate problems before they arise and come up with solutions now, rather than later. And, if litigation does arise, then Ed is here to help.

3W: What does that mean to the families; start to finish estate planning?

Vanessa: Our goal is to provide an estate planning service from start to finish by providing an environment for families to openly communicate so they’re on the same page. It’s not about just drawing up a document because who you name as a successor trustee as administrator of the estate is just as important as the document.

3W: So the successor trustee may not be qualified?

Vanessa: Well, for example, sometimes parents name the oldest sibling as the successor trustee and administrator of the estate. While that may have been a good idea at the time, family dynamics change. Siblings move away and sometimes the younger siblings turn out to be more responsible. So if a parent becomes incapacitated they want to make sure they have named the right person to be their successor or trustee, because being a trustee is not a fun job.

3W: There is a lot more for the family to consider than just having an excellent estate planning attorney.

Ed: Yes. It comes down to who your attorney is as a counselor. Estate planning attorneys and litigators have to be empathetic counselors – someone who is both an excellent attorney and an understanding person.

Vanessa: We are so different from other estate planning law firms because many other firms simply draw up documents. We don’t charge by billable hours because we want the entire family to come in and be relaxed and go over every possible detail.

Ed: That start to finish estate planning process is really driven by our goal to transition wealth while preventing family disputes, and ultimately, litigation. It’s the disputes that can destroy family legacies.

3W: Very impressive. Walk me through an initial meeting with you.

Vanessa: The first meeting is all about the family. We learn about the family by listening to them. We want to know the family’s goals and objectives. The next phase is the design phase where I take all the family goals as expressed during our meeting and put that into the document.

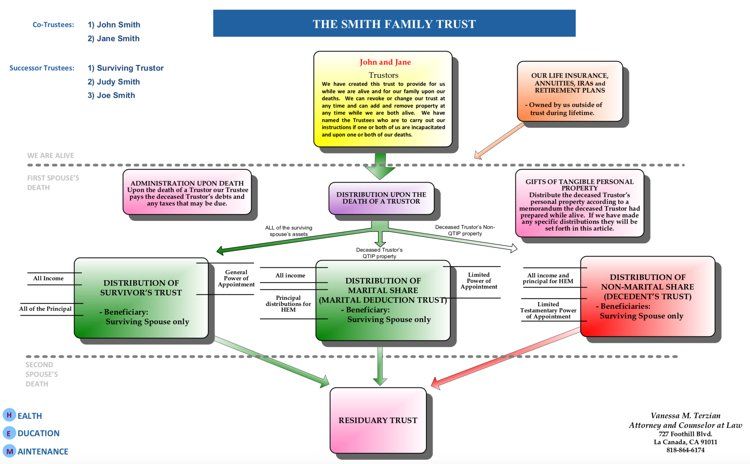

Then I put together a Diagram, a picture of the entire estate plan and trust so the family can see exactly how it works. This diagram is extremely helpful for the family.

The last phase is the funding of the trust. We want all the insurances and assets to be properly located so it won’t trigger probate, and that their assets are administered pursuant to the trust.

3W: What are some mistakes you see in an estate plan or during litigation?

Vanessa: Gifts that are given out right instead of being placed in a trust. Gifts should be in a trust because a trust is protected from divorce, bankruptcy, creditor claims; it’s an asset protection for the next generation. By way of example: if a client gifts $250,000 to each grandchild for their college education it should be placed in a trust specified for that intent. Otherwise if it’s a gift or inheritance the child can do anything they want with it once they turn 18.

3W: Are there any differences between the needs of a middle upper income and an ultra-high net worth family?

Ed: Our goal with every family is ultimately the same; to create lasting legacies through successful transition of wealth and avoidance of family disputes. But we do find that the more you have, the more there is at stake.

Vanessa: Typically, the high net worth clients already have a team in place but it’s amazing how often we find cracks in the plans., because their team usually doesn’t talk to each other!

3W: Who is on their team?

Ed: They’ll have a CPA, an attorney, maybe they already have an estate plan, they’ll have a financial planner or a wealth manager who has them in stocks, annuities, life insurances and real estate investments.

Vanessa: That’s why we do team meetings and family meetings. We like to do them at least once a year to stay current.

Ed: Exactly. Our strength is team building. This goes back to Vanessa’s goal of open communication. Not only do we want to talk with all the family members but it’s essential to talk with the whole financial team. We analyze all of their relevant documents such as tax returns and financials, so that the entire team is on the same page.

Vanessa: If they are not on the same page it’s entirely possible that when their client passes all of their assets might be in a taxable estate. But if we need to go into litigation we’re confident that because of our start to finish approach to estate planning that we are more effective than most law firms.

3W: What are some examples of these situations?

Ed: Well, we represented two brothers whose father remarried toward the end of his life. He ended up rewriting his entire estate plan and cut out his kids and grandkids, leaving everything to his new wife. The kids didn’t feel his intent was honored. They were really hurt because they were very close with their father. So we brought an action to enforce his prior trust and ended up getting a great result at mediation which left both our clients and their stepmother very happy. Maybe more important than the great monetary result, we were able to salvage the family relationship and bring back peace and harmony.

3W: That’s an incredible success story.

Ed: People want to forgive. They just need to see that the other party understands their perspective and where they are coming from. Once that happens, once there is a mutual understanding, people forgive and the case can successfully settle.

Vanessa: That’s so true. We had a case where our client’s original attorney was doing everything right as far as the administration of the trust, but the family was not speaking to each other because their attorney did not establish an open forum of communication. So the family asked for our help and we resolved that case because we know how to bring people together and reach the right outcome for all parties.

3W: Your job sounds very challenging. Where do you find inspiration to continue your practice?

Ed: My inspiration comes from taking cases I believe in. When someone has been wronged, that doesn’t sit right with me. My family went through a dispute that ended up hurting relationships. This really left an impression on me and I knew that I wanted to help other families avoid what I personally witnessed. I really don’t like seeing people being taken advantage of. I’ve spent years in real estate, business and estate litigation. Simply put, it brings me joy to resolve injustices for my clients while at the same time helping salvage family relationships. That’s my inspiration.

“People want to forgive. They just need to see that the other person sees their point of view, and really understands where they are coming from. Once that happens then the case can settle.” —Ed

Vanessa: My inspiration comes from helping keep family relationships strong, while at the same time, creating long lasting legacies through the successful transition of family wealth to generations down the line. 70% of wealth transitions fail and I don’t want my clients to be part of that 70%.

3W: You have offices in Pasadena, Glendale, Burbank, San Marino, and San Fernando Valley, and your main office is in La Canada Flintridge, what do you want to say to our readers?

Vanessa: I’d say don’t be part of the 70% who have trouble successfully transitioning their wealth. I too often see people working hard to raise their children and to build strong family relationships, only to lose it all because they didn’t properly plan for the future. Give yourself the peace of mind that you have done everything in your power to ensure that your legacy will be protected, both financially and emotionally. The only way is through proactive planning centered around a comprehensive approach.

Terzian Law Partners

727 Foothill Blvd.

La Canada, Flintridge, CA 91011

818-864-6174

Trust & Wills, Trust Administration Probate Trust Litigation Advanced Tax Planning Complex Trust Formation Special Needs/Disability Planning Children Protection Planning

vanessa@vterzianlaw.com

edward@vterzianlaw.com

www.Vterzianlaw.com

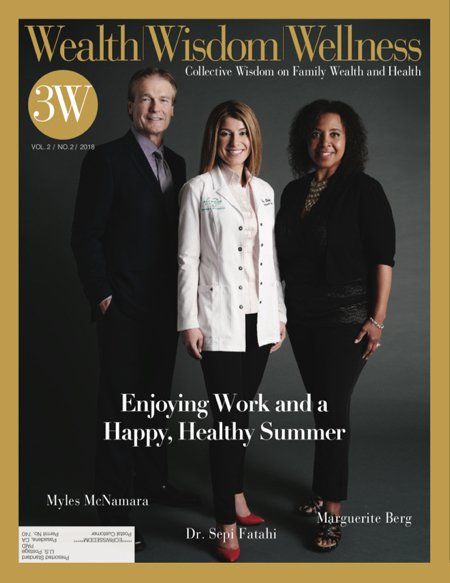

Wealth Wisdom Wellness is published by CT3Media, Inc.

© Wealth | Wisdom | Wellness Magazine. All Rights Reserved.

ABOUT US

Wealth | Wisdom | Wellness is published by CT3Media, Inc.

© Wealth | Wisdom | Wellness Magazine. All Rights Reserved.