Jeff Brandolino on Building a Brand

From Issue #3

From Real Estate Sales to Flipping Investment Properties

Real estate expert Jeff Brandolino, president of the Brandolino Group, Inc., has developed a set of methods and tools to grow his and other local businesses even in an economic downturn.

The Brandolino Group’s story goes back a decade. California’s real estate industry had taken a hard hit over

the first couple years of the Great Recession of 2007. Disappointing job numbers along with stagnant home sales caused many real estate offices around California to shrink.

To keep him and his employees in the real estate business, Brandolino knew something had to change. His vision was to redefine his team’s role as real estate agents by going beyond the scope of a traditional realtor, from sales to investments.

Brandolino aligned his team with a group of private investors to orchestrate the research, acquisition, renovation and sale of distressed properties around Los Angeles County.

Acquiring foreclosures for investment purposes not only proved profitable for the investors, but also helped add construction jobs in various trades, while growing local sales and beautifying neighborhoods throughout L.A. County.

The Brandolino Group expanded. Today, the company is a thriving full-service real estate investment firm based in Valencia, and located on The Old Road.

In 2016, Brandolino and the Brandolino Group earned the No. 1 spot at Realty Executives Santa Clarita for listing sales and number of units sold. In the Top 100 Executives on an international level, the Group reached No. 7 for commissions earned and No. 29 for total units sold.

The Group is comprised of three divisions.

Acquisition of Distressed Properties

The Brandolino Group pursues the L.A. County trustee sales daily, bidding and acquiring properties for flip purposes. Additionally, the Group’s reputation and track record have made them the local go-to source for acquiring distressed properties all cash, in as-is condition. Check out the before-and-after videos at www.BrandolinoGroup.com.

Listing and Sales

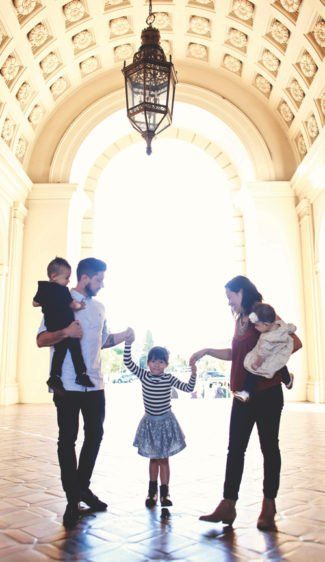

Jeff and Tina Brandolino enjoy quality time with their three children, Benjamin (3), Alyssa (7) and Emma (2)

The Brandolino Group continues its long-time affiliation with Realty Executives, successfully selling more than $300 million in listing and sales and earning national recognition. Brandolino and his group are the No. 1 selling team at the Valencia Realty Executives office in Westridge.

Property Management

After years of experience managing the Brandolino Group’s residential, multi-family and commercial properties, Jeff Brandolino and Tammey Mai formed Valleywide Leasing, Inc., a property management/leasing company. The Brandolino Group thinks of Valleywide Leasing as its sister company. Today, Valleywide Leasing offers its services throughout L.A. County.

Q&A: Jeff Brandolino

We spent some time with Jeff Brandolino to find out more about him and his views on investing in Santa Clarita Valley real estate.

3W: Jeff, how did you begin your real estate career?

Jeff: I started under my uncle and aunt as their apprentice/assistant, and later became a licensed Realtor on their sales team. Starting in sales was a very important chapter in my book. A couple months ago I read about a study of the world’s wealthiest 100 people and the most common first job of billionaires was salesperson.

When the Great Recession hit in late 2006, I sold a property for an investor who later opened the gateway for me and my team into the investment world. Today he is one of my active business partners and continues to be an inspiration to me.

After learning and testing the water with some smaller flip properties and rental property acquisitions, I took the plunge and started an investment company. I took my father’s advice and found partners who had more money than I. They have been my mentors first and partners second and we have done very well. I believe if you ask them they would say the same.

Now I have people who want me to be their mentor. I guess at some point I am going to pay it forward, as they say.

3W: Tell us more about your experience with buying and selling investment properties.

Jeff: I started by buying condos and houses in Santa Clarita, using the residential bank financing available for properties up to four units.

As equity increased over the years, that allowed me to sell and 1031-exchange these properties into larger assets. That is when I decided to move my investments into limited liability companies and create partnerships with my mentors.

Pooling funds helped open the door for buying multifamily (more than five units) as well as commercial properties. It is hard to find five-unit or more multifamily properties in Santa Clarita. But when you can scoop something up it is a nice property for your portfolio. I believe there are more commercial real estate opportunities available in our community for the bigger scale investors.

3W: Can you give us an overview of real estate opportunities in the Santa Clarita Valley compared to other areas of L.A. County?

Jeff: Sure. Santa Clarita is definitely a great place to own real estate. Most of the properties are much newer than what you will find in the San Fernando Valley or on the West Side. Another plus is that there is no rent control in Santa Clarita.

3W: The Brandolino Group and sister company Valleywide Leasing have become well known as the best in class for all real estate needs – buying, selling, investing, leasing, property management and so much more. What do you and your team do differently for your clients?

Jeff: It’s all based on our personal experience with investing in real estate. We have bought and sold well over 500 properties and that is like having a Harvard degree in real estate investing.

3W: What criteria do you have when searching for a good investment?

Jeff: We find value-add opportunities. A property performing at its best can only get worse. We look for properties we can add value to and increase profits by rolling up our sleeves and doing what we do best.

3W: When do you turn down an investment opportunity?

Jeff: We’re always on the treasure hunt. And with that hunt comes our due diligence. We acquire as much information as possible. Despite how interested we might be in a property,

if we don’t see how we could add value or turn a profit from it, then the search continues. Not every investment is a gold mine.

3W: Are there trends with people living beyond their means, being “house poor,” or do you see families investing in real estate living moderately but enjoying rental income which helps pay off their mortgages?

Jeff: In my humble opinion I believe many people do not adequately prepare themselves for retirement. I suggest that once you have a few bucks in the bank, start investing in real estate. It will insure you have something that will pay you rent/income in the future.

3W: Can people manage their own real estate investments, or should they hire a property manager?

Jeff: Yes, of course people can manage their own investments. But if they are very busy and productive with their work it might make more sense to hire a professional management company to manage their rental properties.

We formed Valleywide Leasing because we have so much experience managing our own property portfolio that we now offer property management services to investors. It just made sense that we would not only be able to help our investors find properties, but also manage them.

I have to say that our team is on top of things. Every time I personally buy a property I can close my eyes at night and know it is being well taken care of by professionals.

3W: Is owning property with rental income similar to the concept of paying yourself automatically and first?

Jeff: Yes. If you use leverage and have a bank loan they typically have principal pay down. In theory you are automatically paying down a loan and saving money – or better yet, your rent-paying tenant is paying down the loan for you and saving you money.

3W: Should people pay off their mortgages?

Jeff: Not if they have a fixed loan with an interest rate anything like rates are today. I would suggest riding out the loan since you borrowed money so cheap. Find something else to invest your money in and let the loan ride.

3W: Is there good debt and bad debt? What’s the difference?

Jeff: I guess good debt would be fixed loans with good rate and terms. Bad debt would be adjustable loans and or hard money loans with high interest rates and less than favorable terms. If you are brave enough to accept bad debt I suggest you make sure you have a very solid plan to pay it off. I would only consider taking bad debt for a short-term deal if you are expecting to be profitable.

3W: What inspires you to keep making profits for investors?

Jeff: Well, first, I’m one of the investors. I am a firm believer in always having skin in the game.

It is very rewarding when you are distributing a nice return to your investors each year. We have been fortunate to have remained profitable all these years. When you have good partners the general thinking is that we either win together or lose together and knowing that helps us keep pushing daily.

So to answer your question, I draw inspiration from the pleasure of being successful and delivering a nice return on investment to the people who put their trust in me and my team.

3W: If our readers want to learn more about how they can profit from investing in real estate with your company, how should they contact you?

Jeff: Thanks for asking. For anything investment-related, I would be the best point of contact. For buying or selling real estate, we would connect them with the best agent on my team based on their specific needs. Call 661-600-9410.

They can also visit our website anytime at www.brandolinogroup.com.

Wealth Wisdom Wellness is published by CT3Media, Inc.

© Wealth | Wisdom | Wellness Magazine. All Rights Reserved.

ABOUT US

Wealth | Wisdom | Wellness is published by CT3Media, Inc.

© Wealth | Wisdom | Wellness Magazine. All Rights Reserved.