Leading By Example

From Issue #1

How a Young Man Taught Himself & His Entire Family the Rules of Success to Create Lasting Family Wealth

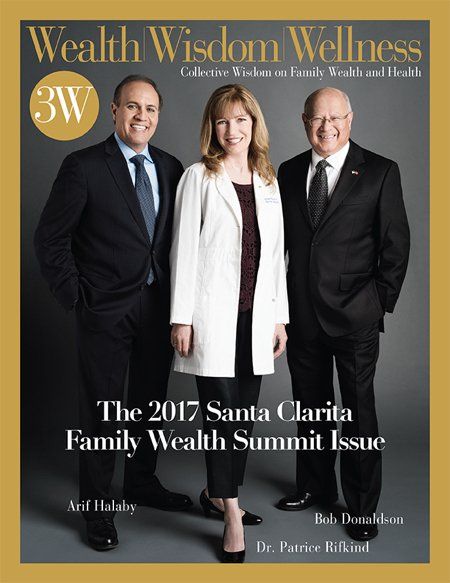

Imagine a hardworking family man. He and his loving supportive wife were able to buy their first home in their 20s and within a decade retire in their 30s because of his financial prowess. Their children are successful young adults. They are literally living the dream. One day while vacationing in Rome and admiring the Coliseum his wife notices a strange look on her husband’s face. He turns to his wife and tells her he just had an epiphany.

He tells her, “Do you realize we are in an amazingly wonderful place and we don’t have any family and friends with us because they can’t afford to be here? We need to go back and expand our company to teach and help others to grow and protect their wealth so they can afford to take wonderful vacations and live the life the way they want to,” Just like that, Arif Halaby began the next 15 years of his career transforming people’s lives by educating them and helping them create wealth and retirement income in their lives.

Arif Halaby has been helping and protecting people his entire life. He learned from his parents who led by example. His father filled their 1,100-square foot home with family and friends from Lebanon – so many in fact that Arif went from living in his bedroom, to the living room and eventually the garage. Arif helped his family acclimate their relatives and friends teaching them English and introducing them to his friends at school.

It was a natural progression for Arif to join Los Angeles Police Department where he protected and served for 11 years. During that time his passion for investing propelled him to save over $150,000, marry the love of his life, and at 28 he became professionally licensed and started his financial practice, now specializing in retirement income strategies and annuities.

We sat down for a few minutes with Arif to learn what wisdom he could share with us.

3W: Arif you married very young, started a family, retired at 33 and decided to start a new venture helping others become wealthy. How did you jump start your success so quickly in life?

Arif: I owe it to my mother and father. They took in so much family from Lebanon and made sure they took proper care of them to help them get on their feet. Growing up in that environment I realized I wanted to help people build wealth to make sure they never had to sleep on the floor and go hungry.

3W: So, you started your own school?

Arif: We founded The Money School and began teaching classes to anyone who would listen. We started scholarship funds at high schools and gave away tens of thousands of dollars to students who held down a job while at school and showed a desire to be an entrepreneur.

3W: And then Robert Kiyosaki heard about your scholarship fund?

Arif: Yes. I had read and implemented many of the strategies in Robert Kiyosaki’s book, Rich Dad, Poor Dad and tripled my income within 9 months. I wanted to teach people how to do what I did which was become wealthy and protect and grow your income.

Robert asked me to be the spokesperson for the Rich Dad Poor Dad series of CDs, DVDs and instructional courses.

3W: Tthe king of the self-made millionaires hired you to be his spokesperson?

Arif: We were one of three families featured, and had a lot of fun doing it.

3W: What is the mission of your company now?

Arif: Our company’s mission is to help families protect their principal savings while achieving reasonable interest rates, and to use simple terms that our clients can understand.

3W: Okay let’s assume our readers have made their money; they’re good at that, how do you advise them when they come to see you?

Arif: I’ll review and analyze their finances and help them protect what they’ve worked so hard to earn. I help them to discover the purpose of their money; meaning, what they want to have happen in their life now and through their retirement years and beyond.

3W: You’re referring to specific plans and goals the family has?

Arif: Yes, discovering the purpose of the family’s money involves discovering their goals. It could be to put their kids through college while still protecting their nest egg, retire at 65, travel the country, buy a vacation home, set up a new business, or a legacy for their grandchildren. Each family has different needs and we help direct those needs to a solid financial solution.

3W: So what is the difference between having good retirement funding and life insurance policies?

Arif: In many cases, you want to leave your retirement accounts to your spouse and your charities. You want to leave life insurance policies to your children because if you leave your children your retirement account they can be taxed up to 90% of it through probate, income tax, state tax, and lawyer fees etc.

3W: Let’s say a baby boomer couple has a good retirement portfolio mix, and 401ks but no life insurance or annuities. They are concerned they’ll outlive their money. What would be a good basic life insurance and annuity set up for them. What opportunities are they missing?

Arif: They could be missing the opportunity to defer taxes on their gains. The annuities we offer have tax-favored growth potential as well as a number of different distribution choices, which can help diversify your income taxes in retirement. And life insurance is free of income tax under current law, which makes it a gift rather than a liability to your heirs.

3W: Are you ever approached to give a second opinion of a family’s portfolio if they already have a team of investment advisors?

Arif: Absolutely, in fact I encourage clients to have a team of financial experts. I play an integral part offering alternative products and services that others on their team do not while offering valuable perspective for balancing risk and providing stable retirement income.

3W: What do you usually find when you analyze an upscale family portfolio?

Arif: Even if people are generating good income and have a very good balanced portfolio, they may not be protected from risk in a stock market decline. I like the illustration of showing my clients that if you have a million dollars in stocks and the market goes up 50% you’ve now got $1.5 Million but if the market declines by 50% now you only have $500,000. Which scenario would be more life changing for you?

3W: Ouch. Obviously losing half a million.

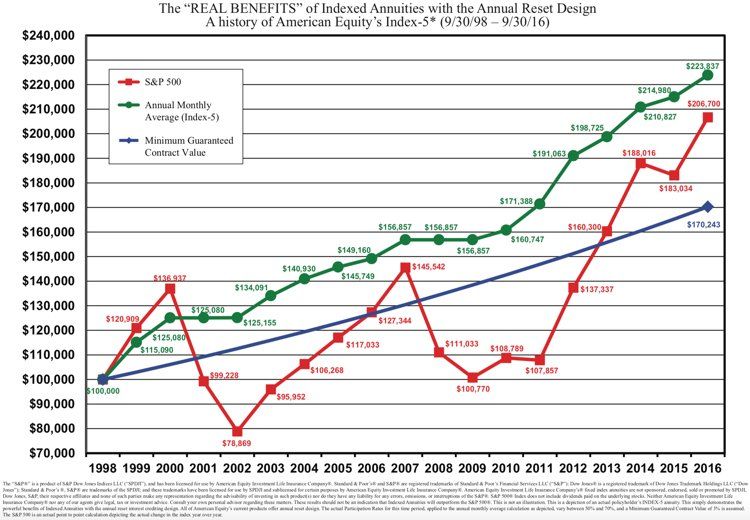

Arif: Right. A Fixed Index Annuity might be a good idea for them because if the market declines it won’t affect their principal nor the interest that is credited to the value. Once the interest is credited, it becomes a protected part of the principal balance and can be used later in life to generate income for you. This chart (on next page) shows the real benefits of one indexed annuity with annual reset design outperforming the stock market over the last 18 years.

“I like showing my clients that if you have a million dollars in stocks and the market goes up 50% you’ve now got $1.5 Million. But if the market declines by 50% now you only have $500,000. Which scenario would be more life changing for you?”

3W: That is eye opening. Clearly annuities beat the S&P 500.

Arif: Well, they’re not designed to, but this example really shows their strength. Take a look at the chart above and ask yourself, “Where would I rather have my money?” We think that most people would say, “I want my money in the GREEN line, at least for a portion of their wealth!”

3W: Absolutely. Annuities guarantee your principal is protected and you can still earn interest.

Arif: Not all annuities. Fixed index annuities are protected from market volatility. They offer principal protection and growth potential for your money. Total Financial Solutions writes their annuities and insurances only with A rated companies.

3W: Can you pass on annuities to your children?

Arif: Yes, at least with the ones we offer. When you pass away, your beneficiary receives whatever money is in the annuity. Even if you started taking income from it, your family would receive the remaining balance. Your beneficiary may choose to receive your contract’s values in a lump sum or in a series of payments over time.

The death benefit may be a reason some individuals purchase annuities even though they have no immediate plans to receive their contract values. They simply want to know the money is available (may be subject to a surrender charge) should they need it – and that it can be passed on to their beneficiaries if they don’t use it.

3W: So you’re more in control of your retirement years and what you leave as a legacy to your children.

Arif: Correct, because a fixed index annuity puts you in control of your future income, based on the annuity you choose and how much money you put into it. After your contract has had an opportunity to earn interest over its deferral period, you can begin taking penalty-free withdrawals as needed, or starting a steady stream of income that will last your lifetime, like a personal pension. It really just depends on what makes sense for you at that moment in your life.

3W: Arif obviously couples should have you take a look at their financials. What do you want to say to our readers?

Arif: I would say let’s sit down and make sure you’re positioned to win. Let’s go over your finances together, and let me give you an unbiased second opinion. I love helping families live well and retire well. It has been my mission since I was a boy learning from my parents. Helping families is so rewarding. Give us a call, we’re here to help you integrate your financial life.

Top 5 Rules for Your Family’s Financial Success

by Arif M. Halaby, CEP

- Adapt and change your financial life as conditions change. The types of accounts that may have worked 20-30 years ago may not help you achieve your future objectives.

- Maximize your earning potential by always staying fresh and ‘up-to-date’ with your skills.

- Retirement should be a time to do what you want, regardless of how much you are paid.

- Talk about money in ways that emphasize opportunity and not limits.

- All money and accounts have a job to do. For example, don’t use money you have set aside for retirement to pay for your child’s college education.

Total Financial Solutions, Inc.

A member of The Personal Financial & Insurance Group, LLC

California Business License #0E11839

“Integrating your financial life…”™

24322 Main Street, Newhall, CA 91321

888-99-RETIR

Wealth Wisdom Wellness is published by CT3Media, Inc.

© Wealth | Wisdom | Wellness Magazine. All Rights Reserved.

ABOUT US

Wealth | Wisdom | Wellness is published by CT3Media, Inc.

© Wealth | Wisdom | Wellness Magazine. All Rights Reserved.