Stocks Aren’t Waiting for Trump to Make the Market Great Again!

From Issue #2

“No matter what happens in the market, you always have an opportunity to find winners. If you have a desire to learn and you discipline yourself, you can be a good investor.”

– Amy Smith,

Investors Business Daily

Amy Smith is Investor Business Daily’s Market Commentator and is the featured speaker on the New York Trader’s Expo, Women in Business Moderator at the Reagan Ranch Center, a featured speaker, AAII (American Association of Individual Investors), Dallas Investor’s Forum Guest Lecturer, the Keynote Speaker of the Las Vegas Money Show and, is the IBD Meetup Director, which is the fastest growing financial group in the Country. She is the author of the bestselling book, How to Make Money in Stocks Success Stories. Amy has been interviewed on many radio shows with hosts Gabe Wisdom, Andrew Horowitz, TFNN Tom O’Brien, Steve Crawley’s American Scene, KNX Business Hour, AM 870 The Answer, Metro News Hotline, Larry Marino, Money Matters Boston, and WBBM Chicago.

3W: How is President Trump affecting the market and what should we be looking for?

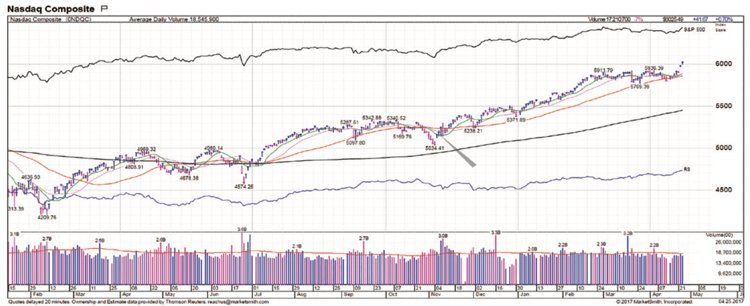

Amy: When the Trump administration didn’t get the votes necessary to repeal Obamacare the market did slide a bit so we had a scary reaction to it. But the market turned around at the 10-week line and 50-day average. It was nice to see leaders in market looking strong. Apple, Facebook, Priceline, and Amazon reacted positively.

3W: Do you see a shift in the market concurring with political events or does the market care?

Amy: Well stocks aren’t waiting for President Trump to make the market great again (laughter). We shifted from political rhetoric; meaning stocks stayed strong after the election and earning seasons started in April. Explosive earnings can propel a market higher and offer great opportunities for investors. Just remember, the market goes up and down, so always check to see what the leading indexes are doing. Investing in an uptrend is important since 3 out of 4 stocks will follow the general trend.

3W: Are we going to see opportunities for growth in the stock market or do you see a downtrend on the horizon.

Amy: No matter what happens in the market, you always have an opportunity to find winners. Go to Investors.com and look at specific sections such as market trend, stocks on the move, research tab, how to invest and how to read charts. If you have a desire to learn and you discipline yourself, you can be a good investor.

3W: I know you teach IBD seminars across the country, can you share a success story of someone who learned from you?

Amy: Sure. People come up to me all the time and share their success. One particular story comes to mind though, we’ll call her Deborah. She came up to me and said I changed her life because she came to my seminars and joined IBD meetup groups. She read my book How to Make Money in Stocks—and she became very successful. She is now a full time investor.

3W: That must be an incredible feeling to know you help change people’s lives by showing them how they can learn simple steps to take financial control of their lives.

Amy: It is very humbling and sometimes humorous. When I was in Raleigh, a guy called me his “Shero” instead of hero (laughs), he studied IBD’s investor rules, read my book, did his homework and now has his own investment advisor group.

3W: That brings me to how you can help our readers. You’ve had a long run with your radio show How to Make Money in Stocks, where can we find your archived radio shows?

Amy: How to Make Money in Stocks has about 250 shows on iTunes.

3W: How much does psychology play a role in stock investing?

Amy: You have to have discipline. You have to follow the rules. They are simple rules but you have to follow them and not let your emotions keep you in a stock that is underperforming.

3W: What are some of your main rules to follow?

Amy: Have a defensive plan. Never take more than a 7% loss on what you paid for a stock. You also need an offensive plan. Successful stocks can run 25% or more before consolidating. When a stock hits your profit goal, you can move the trailing stop higher so you don’t give back all of your gains.

3W: What stocks are you looking at as we approach the new administration’s 100 days?

Amy: Look for winners that show accelerated earnings. Earnings season provides investors with great opportunities. Keep an eye on Facebook, Amazon, Netflix, and Apple.

3W: How can our readers take advantage of your personal knowledge?

Amy: I’m always reachable at Amy.Smith@investors.com. I want to encourage your readers to contact me with any questions they may have as I’m always happy to help.

Amy.Smith@investors.com

http://shop.investors.com/offer/splashresponsive.aspx?id=Trading Summit

Wealth Wisdom Wellness is published by CT3Media, Inc.

© Wealth | Wisdom | Wellness Magazine. All Rights Reserved.

ABOUT US

Wealth | Wisdom | Wellness is published by CT3Media, Inc.

© Wealth | Wisdom | Wellness Magazine. All Rights Reserved.