“Want to Create Financial Fitness for Life?”

From Issue #2

“Organize Prioritize Optimize!”

“The financial wealth industry still thinks it’s in the money management business. It’s not, it’s in the behavioral management business.”

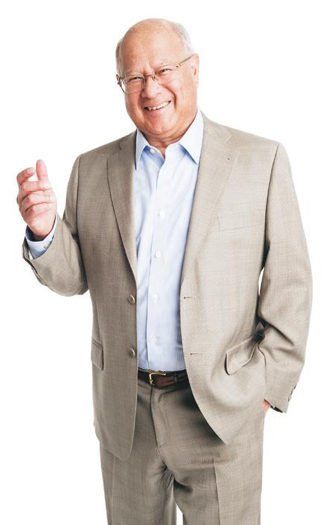

– Bob Donaldson, Founder and CEO of Advisory Group West

Bob Donaldson is an accomplished Chartered Financial Consultant, who crafts personal, specific and clear strategies for families. His 40 years of practice led to the creation of Advisory Group West’s comprehensive educational and behavioral processes for ‘Financial Fitness for Life.’ 3W sat down with Bob at his office in Glendale to talk about his beliefs and philosophies of attaining and maintaining wealth.

3W: How do you help people with their finances?

Bob: We help organize, prioritize and then, optimize. The objective is “Financial Fitness for Life.”

First organize.

Make sure your ‘why’s’ are clear and compelling to all stakeholders. Examine how you’ve organized your culture for decision making. If failure is not an option, can you afford to keep ‘shooting from the hip’? What are your organizing principles for making financial decisions? What is it that’s important about money, to you? The result is your motivation and enthusiasm reaches levels sustainable for life. Remember we’re aiming for “Financial Fitness for Life.”

Second prioritize.

No one can manage time. We can only manage priorities. Step by step, we’ll educate you to personalize your agenda with the specifications that relate to you. Only solutions that meet your specifications can be considered as candidates for solving your issues. Once you learn to do this, you’ll never go back.

Now we can optimize.

Optimizing is mostly about containing costs. Financial fitness covers four sectors: Asset Protection, Lifetime Income, Diversified Investments, and Estate Preservation. Now we begin personal, specific and clear recommendations in each of those four sectors, in that order.

Clients now know where they’re going. All stakeholders resources are now channeled to get to where they want. Now they get to live the life they want.

3W: What are the pros and cons of someone doing their financial planning on their own versus someone who is doing it with an advisor?

Bob: With regret, I watch people jump into waters they don’t know how to swim in. It’s easy for the layman to underestimate the complexity of tasks, and they always overestimate their prowess. This is especially daunting when failure is not an option in retirement. It’s a tough enough task for advisors like me that take decades to learn how to orchestrate so many puzzle pieces. Too many folks struggle for the longest time and they’re still uncertain their efforts will get the financial security they so desperately seek.

3W: What are some of the mistakes that you find the do-it-yourself financial planners make?

Bob: As I say, the biggest mistake is underestimating the challenges. It is a very complex situation. It’s similar to having someone arrive with a whole bunch of puzzle pieces without having a picture on the box. They’re trying to put a puzzle together without knowing where it is going – much less have a process for putting the puzzle together. That’s not fun, it’s torturous.

3W: How do you help people who might already have accrued a little bit of everything: they have some annuities, they’ve bought some insurance, they and some stocks, and…

Bob: That’s the most common scenario.

Clients arrive with a huge pile of assets, like a patchwork quilt of ‘shiny’ things that sounded and felt good at the time. There’s no telling where that pile of stuff is taking them, and therefore a lot of uncertainty and anxiety. Even with a lot of assets, they don’t know where it’s taking them.

And there’s little room for error in terms of time. Trying to orchestra all those moving pieces by trying to do it yourself just looks like so many landmines to me. That’s why they arrive here.

“You can’t control what the President or Congress is doing. You can only control what you are doing. Don’t fret the wind, fret your sails.”

3W: Should we be wearing a crash helmet with President Trump in 2017?

Bob: The answer is yes. (laughs) You should always wear a crash helmet. And you should always wear a seatbelt. I’m more concerned with what you are doing, less about who is president. You can’t control what the president or congress is doing. You can only control what you are doing. Don’t fret the wind, fret your sails.

3W: How can you help an upper middle class family grow their nest egg?

Bob: By the time a person arrives here they are well on their way to wrapping up the accumulation phase of their working life. It’s making that ‘nest egg’ produce for the rest of your lives that is the greatest source of anxiety. So we want to bring personal, specific and clear processes to the next “thirty-year” vacation, if you will. That’s where the challenges lie. The accumulation phase was the easy part.

3W: To what do you attribute your success?

Bob: We care about the people we serve. It’s an earned privilege to serve. Do it well. Yet no matter what success we’ve achieved, we keep trying to improve our firm, to make sure that each client is getting very highly personalized service. And that is very gratifying to me.

It’s interesting that the financial wealth industry still thinks it’s in the money management business. It’s not. It’s in the behavioral management business. I look at it as helping people make the smarter choices. Before you give instructions to the account manager, you had better have a very good plan of what you’re trying

to get done with each different account in your overall financial life plans. That you’ve segregated the different pools of assets to the different tasks that you have from saving and reserves, to elder-care, to health-insurance, cash flow, life insurance, growth assets, etc., all the different things that you’re wanting money to serve.

3W: Do people come to you because they are unhappy with their financial advisor?

Bob: Yes, but it’s more like they are underwhelmed by their experiences with them. They intuitively wonder how come they have a lot of money, but they’re not experiencing the security they expected that money to provide them. They’re still anxious. How can that be? It has to do with not having a clear picture of where it’s taking them.

3W: Walk us through the steps of when someone first comes to visit you.

Bob: Well, the first thing I do is congratulate them for taking the time to be here, which tells me they’re serious about making smart choices. This is the time each husband and wife, or partner, gets to express what it is that’s important about money to them as an individual. And it’s often a revelation. Sometimes they’ve never heard each other speak as to what’s important about money personally.

This second stage is a joint conversation. It is a collaborative conversation where they identify, with specificity, what their goals are, how much in after-tax dollars they are determined to generate to support their lifestyle.

3W: And what’s the next step?

Bob: Then we take a look at the resources that they have in order to accomplish that. From pensions, social security, taxable accounts, home/auto insurance, pre-tax accounts, rentals, home, debts, life insurance, annuities, etc. This is bare bones basic hard data, so they start to get a whole picture of what their resources are.

3W: At this phase they may still not be confirmed as a client. So, what’s the next step?

Bob: No, that first visit is simply a ‘getting to know each other’ visit. They get to express themselves and do ninety percent of the talking. I do 90 percent listening, making certain we’re using similar vocabulary. Only in the second complimentary visit do I begin reflecting on what they’ve shared. By the last third of that meeting I’ll illustrate their estate distribution patterns on a white board. By looking at how their assets are titled and their trust is set up, we can illustrate how this trust assets and all other assets are actually shaking out in their particular case. They’re usually quite shocked. Seldom is it what they thought it would be. There are so many moving parts. Nobody’s taken the time to do that or to show them the consequences of each step in that process.

3W: Where do you draw your inspiration from? What keeps you going and helping people?

Bob: The short answer is, when you’re good at something I’ve found it reaffirms and motivates you. I am a hundred times more passionate and committed to what I’m doing than I ever was. I wasn’t expecting that. It doesn’t look like I’m going to retire in the traditional way. I don’t know what else to do. I love gardening and reading and history. I love traveling and I’ve seen the world. I love golf, although it doesn’t love me back (he laughs). But there is nowhere else I’d rather be than right here doing this work for people. I’d be doing it anyway because it so interests me.

3W: Would you say your love of your work is born of your desire to help others?

Bob: Einstein was once asked, “Why are we here?” His answer was simple and it’s always resonated with me. He said, “We’re here for each other.” And, when you do that, when you live that way, it is simply amazing. You’re the one who gets all the benefit.

3W: What do you say to people who think it’s too late to successfully retire?

Bob: If you think it’s too late to successfully retire, you need to know that you’re creating your own reality. You’re ‘jailing’ or limiting yourself. You just precluded your progress. Remember you get to define what is ‘successfully retiring.’ Self-imposed limitations consistently sabotage folks. “Too late” is defined by you. Remember, we can’t manage time, we can only manage priorities.

“Einstein was once asked,‘Why are we here?’ His answer was simple and it’s always resonated with me. He said, ‘We’re here for each other.’”

3W: What’s the greatest challenge that married or single women face when it comes to finances?

Bob: I believe that the greatest problem for women is often that their voice is de-minimized or not given air, and they are the ones that suffer the most.

When women come to our office, I often sense enormous insecurity. Oftentimes she has a hard time feeling that she has a license to even ask about this stuff. So, we go out of our way to make certain that women are well-armed, well-versed for making confident financial choices.

3W: When you work with someone on their finances, is it more of an emotional or intellectual exercise?

Bob: It’s mostly emotional. Couples often fear that they’re not going to be aligned as they go forward. Those fears are overcome by educating and by being very patient and helping them realize that everybody is in the same boat. Nobody arrives without a bag full of insecurities about money.

3W: If one of your clients were to recommend you to someone they know, what would you like them to say about you?

Bob: He cares. He really cares about understanding you and what you’re trying to do with your life’s work; the life you’re trying to live. He’s wanting to enhance your life. (Bob stops and thinks) I can’t think of anything more fulfilling than that.

Robert Donaldson is Founder and CEO of AdvisoryGroupWest. As an accomplished Chartered Financial Consultant crafting personal, specific and clear strategies for the high net worth investor, Bob’s 40 years of practice led to the creation of AdvisoryGroupWest’s comprehensive ‘Financial Fitness for Life’ services. Your personalized educational experience works to elevate your con dence that each choice you make is integrated for improved Asset Protection, Lifetime Income, Diversified Investments and Estate Preservation.

AdvisoryGroupWest

Bob@AdvisoryGroupWest.com

330 N. Brand Blvd., Ste. 910,

Glendale, CA 91203

Phone: (818) 241-9061

Fax: (818) 241-9062

www.AdvisoryGroupWest.com

Wealth Wisdom Wellness is published by CT3Media, Inc.

© Wealth | Wisdom | Wellness Magazine. All Rights Reserved.

ABOUT US

Wealth | Wisdom | Wellness is published by CT3Media, Inc.

© Wealth | Wisdom | Wellness Magazine. All Rights Reserved.