You Can Retire in Style Without Paying Fees or Losing Your Principal

From Issue #2

Arif Halaby is the CEO of Total Financial Solutions. Arif is not interested in making you rich, rather he is dedicated to making sure you don’t go broke. He helps you plan for a steady stream of income during your retirement years from indexed products. To retire in style, with the life you want, starts with a visit with Arif and together you can make a plan for perhaps the most important years of your life.

“We don’t speculate with our client’s money; we protect their money and grow it steadily over time.”

3W: Arif in our last issue our readers learned that you retired in your thirties due to your financial prowess, were featured in an ad for Robert Kiyosaki (Rich Dad, Poor Dad author) and have dedicated your life with your company,Total Financial Solutions, to keeping people from going broke by utilizing annuities and insurance to protect their hard-earned money. I’d like to start off this interview with a story about how you’re different from other financial professionals.

Arif: Sure, I’d be happy to. A woman came to see us after she had met with other firms and she told us, “Everyone wants my entire portfolio. They don’t understand that we’ve just met. It’s like they want to get married on the first date. All I want to do was to take it slow and get to know my advisor.” So, I told her what I tell everyone who comes to see us, “Let’s just work with one account and let us prove ourselves to you first.” Long story short, we did very well for her. Had she gone with a different company she may have lost thousands of dollars. She recently called me and said, “I see the market is in decline. Did I lose any money?” I said, “No you did not. Remember we aren’t going to make you rich we’re going to keep you from going broke.”

3W: What do you mean by keeping people from going broke?

Arif: Our mantra is “Safety First.” Safety means not losing any of your principal. In other words, it doesn’t matter if markets go up or down, your money is protected from loss.” When we talk about safety first retirement strategies, the one big key component is not losing your principal. The second component to address is fees. I have seen fees you might have to pay to grow your money that can eat you alive.

3W: How do fees eat you alive?

Arif: Each year your retirement money grows, there can be fees on your money. The same money that you paid a fee on last year. So that same dollar is suffering a fee every year, over and over again, making it very difficult for that dollar to grow because it constantly has one foot on the gas and one foot on the brake.

3W: Can you give us an example of how fees eat away at our gains every year?

Arif: Sure, a client opened an account with a broker several years ago and put in $130,000. Today, it is worth $146,000. She came to our office and said, “Arif I’ve made $16,000 and certainly it’s better than losing.” But when we looked at her fees and costs, we discovered that it had cost her $21,000 to get that $16,000 return.

3W: Wow! People don’t take into account the fees that come with money management in the stock market.What about people who like to invest in the market?

Arif: We don’t mind you being in the stock market, but you need to know that the stock market can be 100% at risk. Think of the stock market as a bus. The front is risky so you might play it safe by sitting in the back of the bus. If the bus goes off a cliff; you’re still going to hit the bottom, it just takes a little longer. The outcome is the same no matter where you are on the bus.

3W: Good analogy. Then what would you advise people who have other investments and what percentage of a couple’s net worth should be in principal-protected assets such as annuities?

Arif: We call it the ‘Rule of 100’. Start with 100 and subtract your current age. This is the percentage of your money you might want at risk. So, if you’re 55 years old, then you could have 45% at risk, and 55% safe.

3W: What products do you use for “safety first”, to protect people’s principle and give them a steady stream of income for the rest of their lives?

Arif: We mainly recommend fixed and indexed annuities, but we use other insurance products as well, depending on the client’s goals and needs. The important thing is that we see steady growth while protecting the principal along the way, without putting the client’s money at risk. The products we use are built on contracts and guarantees with insurance companies that have a legal obligation for them to protect and perform, as opposed to products that are speculative. We don’t speculate with our client’s money; we protect their money from market decline and grow it steadily over time.

3W: Do you meet people who are successful but don’t think they earn or save enough to have that correct percentage of their money in a solid retirement plan?

Arif: You can earn $30,000 per year and be wealthy 25 years from now, or you can earn $30,000 per month and be broke 25 years from now. Being wealthy is rarely a determinant of your income. Saving for anything is a long-term goal. It’s a habit to save money. Just like you pay your mortgage and utility bills, you should be paying yourself and putting money into your retirement accounts because statistically speaking, we’re going to live a long time.

3W: So, it’s not the amount of your paycheck that makes you wealthy, it’s your behavior with your paycheck that makes you wealthy.

Arif: Or broke. Let me give you an example. A father and son came to see me. The father retired years ago in his 50s. The son recently retired in 50s as well. But here is the difference between the two. The son retired when the market was at an all-time high. He was making a lot of money and buying toys, boats, vacation homes, jet skis, cars, and storage units for all his toys. But the father consistently put money aside when he retired so by the time he was in his 70s his retirement accounts were yielding more money every year than he was spending. His son first came to me when he was in his 30s and felt that he had a long time to live and put off focusing on his financial future. So now 25 years making that big monthly income and spending it, the son is sitting in my office, with his father. His father said, “Son, the markets go up and down but your bills always go up; they never go down.”

3W: The wisdom of fathers.

Arif: Exactly right. If you have all money in stocks and the market declines while your bills go up, you might run out of money. But if you have investments that keep up with your bills you have a better chance of being protected. We want to outpace inflation, eliminate fees, and most importantly, we want to preserve principal. Those three concepts can increase your overall rate of return because we never have to go backwards.

3W: So its not about a high rate of return as much as it is getting a reasonable rate of return and protecting it from fees?

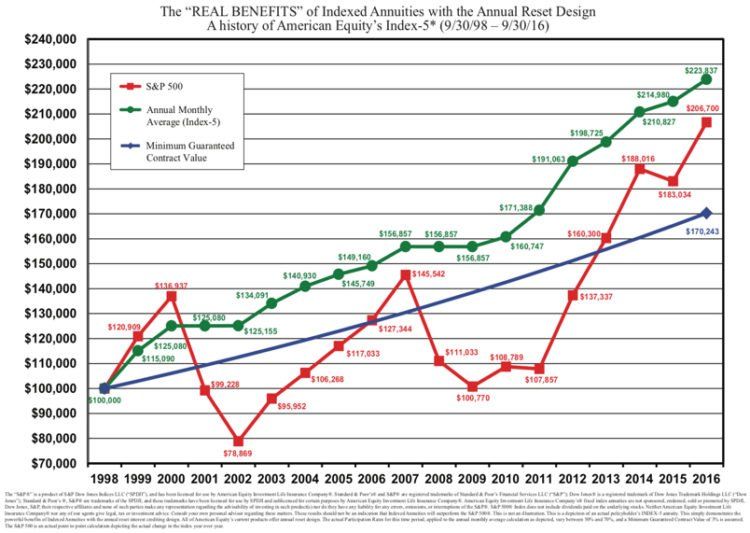

Arif: Yes. And the amount of risk if you chose to invest in risk assets like the stock market. The chart on the next page shows you that you can earn a lower rate of return and end up with more money. People think it’s only about rates of return; it’s not. As I said, two things can affect your principal: 1) the market can go down, and 2) fees can eat you alive. Pay attention to your risk of losing your principal, and the fees you pay against your gains.

3W: This is fascinating because the annuities made more than the S&P 500.

Arif M. Halaby is a Certified Estate Planner in California and is President/CEO of Total Financial Solutions, Inc., a financial and insurance services company based in Santa Clarita, California, with offices extending to the Simi, and Antelope Valleys.

Arif: Exactly, it is not designed to beat it, but it did during this timeframe. Let me share this story with you. A gentleman retired at 50 with a pension of $450 per month. Social Security was going to give him $750 per month, but of course he couldn’t take his social Security until he was 62. In the meantime, he had to pull money out of his savings to live. So, he depleted much of his savings waiting to turn 62. We worked with both his wife’s accounts and his accounts and structured their life to preserve what they had and establish guaranteed streams of income. They are comfortable now.

3W: Is it common for people to retire and start living the good life, thinking the good times in the market will stay?

Arif: What I see is that retiring at the height of the market is very misleading and euphoric because people get the impression that the market is always going to go up. This makes people feel comfortable with spending a greater percentage of their retirement money. But if the market declines by 20% they need to understand that their mortgage, car payment, insurance, utilities and grocery bills are not going to give them a 20% discount.

3W: Give us an idea of the products you use and the insurance companies you choose to work with.

Arif: We only work with A-rated companies. There are about 30 companies that offer fixed annuities. We work with about 6 to 8 of those at any one time that have contracts with guarantees, no fees, and have a track records of success. When we see companies that have consistencies in these areas then we work with them. No matter what company we work with, our members always have the final choice between several different options.

3W: Arif you truly have a calling; a vocation. You take it upon yourself, to help families live comfortably and financially sound throughout their retirement years. You are helping not only the parent’s and their children but the parents of the parents.

Arif: We believe the family’s goal with their financial advisors is to make sure that aging parents can afford to live without being a burden to their children financially. Otherwise you’ll have to take them in, which is honorable, but my point is that you want choices and having enough money gives you those choices. People are much happier when they have choices.

Total Financial Solutions, Inc.

A member of The Personal Financial & Insurance Group, LLC California Business License #0E11839

“Integrating your financial life…”™

24322 Main Street, Newhall, CA 91321

(888) 99-RETIR / info@tfswealth.com

Wealth Wisdom Wellness is published by CT3Media, Inc.

© Wealth | Wisdom | Wellness Magazine. All Rights Reserved.

ABOUT US

Wealth | Wisdom | Wellness is published by CT3Media, Inc.

© Wealth | Wisdom | Wellness Magazine. All Rights Reserved.