Beyond FANG: IBD’s Amy Smith Spotlights Four High-Performing Stocks

Issue #4

What do Netflix, SolarEdge, Etsy and Shake Shack Have in Common?

Former host of Investor’s Business Daily’s Market Wrap, Amy Smith also co-hosted IBD’s “How to Make Money in Stocks” radio program and wrote the companion book “How to Make Money in Stocks Success Stories” (McGraw-Hill, 2013).

Smith is a frequent speaker and panelist at major IBD events, where she shares her prescient views of current and future market conditions. A keynote speaker at Wealth | Wisdom | Wellness’ inaugural Santa Clarita Family Wealth Summit in May 2017, Smith was profiled in 3W’s premiere issue and her tips featured in our second and third issues as well.

In this edition, Smith spotlights four stocks that were major movers in the tumultuous first two quarters of 2018.

3W: The FANG stocks – Facebook, Apple, Amazon, Netflix, and Google parent Alphabet – sold off a bit but otherwise survived the market’s volatility earlier in the year. But you’ve also been tracking a few major movers that aren’t as well-known.

Smith: Yes, let’s start with one of the key FANG stocks and then a few people may not be as familiar with.

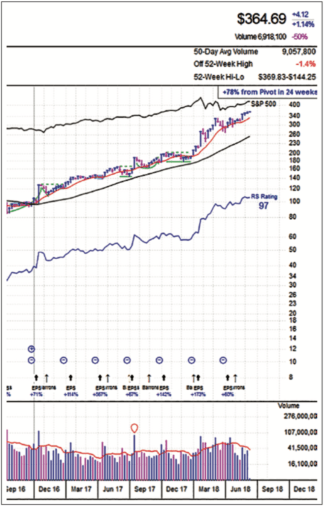

Netflix [NFLX, NASDAQ] of course is a FANG stock that everybody knows: a lot of original content, TV shows, comedy acts, documentaries. Even though Netflix raised the subscriber rate last year, they still saw subscriber growth, not only in the U.S. but also internationally. That’s why the stock recently topped $360.

Netflix is also a liquid name, meaning it trades 10 million shares a day in its average daily volume.

Netflix’s next report is August 1.

SolarEdge [SEDG, NASDAQ], revolutionizing the way solar power is collected and stored even on a cloudy day. Their residential and commercial applications have made this stock go higher.

Their earnings top at 142 percent in the most recent quarter. Their stock is at about 73 percent for the year.

And, I’m sure you probably heard recent- ly that California passed a law saying that newly built homes must have solar panels by 2025. So, this is an industry that will continue to go up.

Etsy Inc. [ETSY, NASDAQ] is a website that sells handmade goods. It’s a place where artisans and craftspeople who don’t have their own websites can set up and manage their own e-commerce store. I have a friend who sells handmade pillows on Etsy. It’s a newer IPO, in April 2016.

Etsy disrupted the way crafty items are sold. They actually solved a problem for individuals or small business owners who don’t need or want their own websites. Companies that solve a problem tend to go up in value.

Shake Shack Inc. [SHAK, NYSE] is the final name I have for you. It’s a burger chain. So, what’s new about this?

Well, they have great milk shakes people love. Their earnings have beat expectations. The stock price was up like 35 percent in one 11-day period. Its 52-week range as of mid-June is $30.12- $65.47.

So, the newer IPOs can sometimes really generate big gains, but of course, not all do. Facebook, Twitter and Snapchat didn’t do well at all when they first started trading. It was only after Facebook came out with its first big earnings numbers that the stock really took off.

You can see what Netflix, SolarEdge, Etsy and Shake Shack have in common. In a word: innovation. They are all success stories because they’re doing things nobody else is doing – or doing quite as well.

IBD: Bringing together some of the smartest minds in the industry to show you stock ideas, market trends and profit-boosting ideas.

Try IBD Digital 5 weeks for only $5. Go to Investors.com to get started today.

Wealth Wisdom Wellness is published by CT3Media, Inc.

© Wealth | Wisdom | Wellness Magazine. All Rights Reserved.

ABOUT US

Wealth | Wisdom | Wellness is published by CT3Media, Inc.

© Wealth | Wisdom | Wellness Magazine. All Rights Reserved.