Aviator CPA Gives Overview of New Tax Law’s First Year

It's All About Finding The Balance

Story & Photos by Stephen K. Peeples

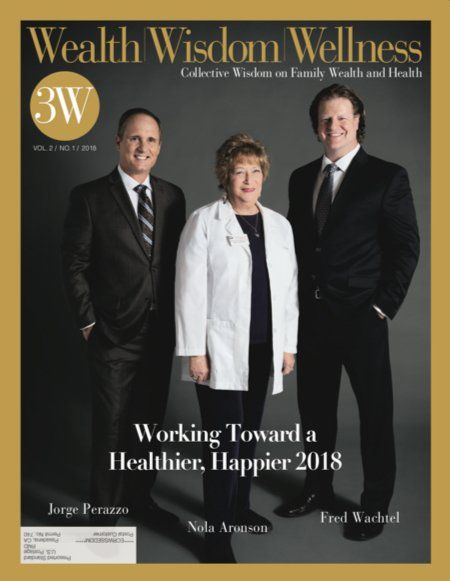

When Wealth | Wisdom | Wellness last spoke with Valencia’s Aviator CPA, Jorge Perazzo, the Tax Cut and Jobs Act passed by Congress had just been signed into law by the president.

As we neared the end of the second quarter since the law took effect in January 2018, we checked back with Perazzo and his wife and partner Peggy for a mid-year update.

3W: The transition to the new tax law must be a challenge for you and other accountants who also work with high-wealth clients.

Jorge: Yes, but the most challenging part about the new law is that it’s not straightforward.

Yes, it doubles the standard deduction for individuals, but they lose the personal exemptions. Yes, the tax rates are lower, but itemized deductions are limited to $10,000 for state and property taxes.

Yes, there’s a $2,000 per child credit, but no itemized deductions for below the two-percent threshold. Deductions like union dues, tax prep fees – those are gone.

So, there’s no way for me to look someone in the eye and say, “You’re going to pay less tax.” Truth is, I don’t know until I run the numbers.

When I first had a sense of what the new tax law was like and was talking to my clients, I threw out the concept of a bell curve.

The more money people made, I thought, the more they would benefit from the tax law change. Well, that’s generally true, but at a certain point, they break even or pay more tax. As it’s turned out, the bell curve is flatter than I expected. That bubble is a little more stretched out than I thought originally.

It seemed like I had another little tax season built into my regular tax season this year. Almost every time a client came in

to do their taxes, their first question was, “What’s going to happen in 2018 with the new law?” So, while we were doing their 2017 tax returns, we were also running scenarios for 2018, all things being equal with their income, expenses and so forth.

Thankfully the extra numbers-crunching didn’t take us too much longer. New software came in that provides us guidance in comparing the IRS’s 2017 tax code versus 2018. So, when I returned the client’s tax return copy, I also included a separate sheet that projected what their taxes for 2018 would look like – again, all things being equal.

Peggy and Jorge Perazzo are a power team for their clients.

3W: That’s the personal side. What about your business clients?

Jorge: No matter which way they slice it, people who own businesses win. This law was really designed for them. Everyone who owns an LLC, or rental property, an S-Corp gets a K1 or reports pass-through income for the net taxable income of the business they actively participate in. That net taxable income (known as Qualified Business Income or QBI) is reduced by 20 percent under the new law before tax is applied.

With some exceptions like service business, like lawyers and accountants, if they make more than $400,000, they don’t get the deduction.

But for the most part, business owners will. I have a manufacturing client who’s going to get the 20 percent break. Another client, a veterinary center, will, too.

I had a lot of business from LLCs that elected to be treated as S-Corporations so all the money that comes in for self-employed people doesn’t just land on their Schedule C, and they wind up paying self-employment tax on all their business income.

Instead, they cut themselves a salary, manage the self-employment tax and how much they pay on their Social Security. They can set up and manage 401Ks. And as a result, they save taxes, plus they get the 20 percent QBI deduction. So, I must have set up 15 LLCs this year for people with S-Corp elections.

3W: What do you see on the horizon in the third and fourth quarters of 2018?

Jorge: My tax planning will be magnified as we get closer to the end of the year because of this new law.

Clients are already starting to say, “Okay, so we talked about 2018 briefly when you did my 2017 taxes, and you gave me a preview. Now that we know more about what’s going to happen in 2018, what will my taxes really look like?”

Fortunately, our updated software is making it much easier for us to provide the answers.

3W: Speaking of tech, last time we spoke you said your operation was almost paperless.

Jorge: We’re even more paperless now. That’s our other big development this year. Both Peggy and I got new iPad Pro tablets we’re now using instead of paper notepads. We can write notes and save them as PDFs. We never print anything.

And when somebody comes in we scan their documents and give them all back. After that, we don’t touch any paper. It’s not so much about saving the paper, even though that’s also good. It’s mainly about efficiency.

3W: Along with being a CPA, you’re also a savvy business advisor who people trust to protect their personal wealth or businesses. But who do you look to for advice when considering ways to build your own practice?

Jorge: That’s something we’re doing now with Mike Myers from Johnson Myers Consultants. He’s helping us a lot, doing flowcharts, for example, of our processes so we can figure out better ways to work.

Believe it or not, the one or two minutes less we spend doing mundane things enables me to help my current clients be more efficient.

The veterinarian I mentioned, for instance: He and his wife own one of the largest pet clinics in the SCV. She’s the vet, he runs the business. He had a gut feeling their expenses were higher than they should be. So last year I ran a financial analysis of their company, comparing key performance indicators against benchmark points of their industry.

Theirs was really easy to pinpoint: veterinarian with sales up to X. With those statistics in hand, we saw that last year, for example, they overpaid their lab fees. The benchmark was three percent, but they were at seven percent, paying more than double what they should have. So, we confirmed his suspicion and he went to work on renegotiating their lab fees.

When we met again a few months later he was improving his lab fee costs but was hyper-focused on controlling his expenses. But now, I said, he should focus on the top line: bringing in more clients. If he didn’t bring in more money on the top, he was never going to see a better cash flow result since, for the most part, his expenses were reasonable.

I said, “Just using a number for the sake of argument, say you’re going to save $20,000 a year by hyper-focusing on your expenses. Well, since there’s nothing more you can do to cut expenses, what if you hyper-focus on sales instead, and increase sales by $100,000? Wouldn’t that be better than just saving $20K?”

3W: Last time we talked, you were looking forward to getting back up in the air after tax time.

Jorge: Yes, tax season was a bit more intense and lasted longer this year, but I finally got together with my instructor in early June for a Piper Cherokee flight to get my pilot’s license current, so I’m ready for takeoff.

3W: Do you and Peggy plan to fly to any major tennis tournaments this summer?

Jorge: We were trying to find mixed doubles teams we can sign up for, but it’s tough. One was in Delaware, the other Austin, Texas. That was about it. But we do want to get out there and participate more in some family sports, couples sports. Maybe just not so far away.

3W: You both work hard, you deserve to play a little. And breaking out of one’s daily environment and routine is good for one’s mental health.

Jorge: Peggy and I have talked a lot about that. There’s more to finding the balance of work and life than meets the eye. But if you don’t find it, you’re a lot more likely to die of a heart attack at your desk while you’re working, or within five years after retiring.

We wondered why people work so hard most of their lives just to have all this money at 65, for the next 15 or 20 of what may not be their best years. Why not stop and smell the roses along the way?

Peggy and I agreed that we don’t want to work full-time full-throttle until we’re 65, and then stop and retire, which is what people have been wired to do for generations.

I’m certainly not saying you should not work hard and plan and save for retirement. That’s all good, and Peggy and I do all that, too.

But we don’t need to drive ourselves crazy about working so hard. We also need to enjoy life. For us, it’s all about finding the balance.

The Office of Jorge Perazzo Certified Public Accountant

Accountancy Corporation

23822 Valencia Blvd. Ste 306

Valencia CA 91355

661-481-2219

jorge@jorgeperazzo.com

jorgeperazzo.com

Wealth Wisdom Wellness is published by CT3Media, Inc.

© Wealth | Wisdom | Wellness Magazine. All Rights Reserved.

ABOUT US

Wealth | Wisdom | Wellness is published by CT3Media, Inc.

© Wealth | Wisdom | Wellness Magazine. All Rights Reserved.